The euro has been rising for over a month now, raising many questions about the justification for such movement. Currently, the latest upward wave still fits within the current wave pattern, but even a slight increase in quotes could break it or require significant adjustments. Therefore, the 1.0880 mark is very important for both the dollar and the euro. However, in this review, we will not discuss the wave pattern but the news background. In my opinion, the market uses many factors solely to buy the euro, which is not entirely fair to the dollar. Thus, it is important to understand which upcoming news might trigger a rise in the EUR/USD pair and whether there will be any at all.

Let's look at the event calendar. The first important event in the euro area won't happen until Wednesday. European Central Bank President Christine Lagarde is scheduled to speak, and I do not expect any new information from her at this time. Lagarde expressed her position two or three months ago. According to her, the beginning of policy easing is permissible at the start of summer. Since then, nearly the entire Monetary Policy Committee has voiced support for the president, and only Isabel Schnabel has expressed doubt that the rate will be lowered directly in June. However, the vast majority of her colleagues believe that June is a suitable month for the first round of easing. Therefore, I believe that Lagarde will not change her rhetoric.

The business activity indices in the services and manufacturing sectors for May will be released on Thursday, with no significant changes expected. The manufacturing sector is 99% likely to remain below the key 50.0 mark, while the services sector is 99% likely to stay above this mark. Of course, the actual data of these indicators and their relation to market expectations will matter.

On Friday, Germany will release its GDP report for the first quarter in its final estimate. The market expects a 0.2% growth quarter-on-quarter, which is quite small for an economic recovery. The economic recovery will not begin until the ECB starts lowering rates. As we can see, there are no substantial reasons for the euro to rise.

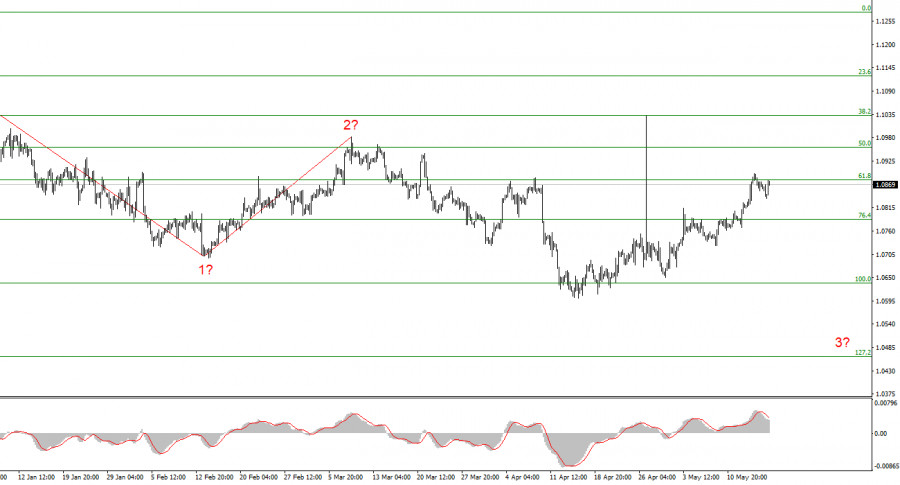

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. In the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark. An unsuccessful attempt to break through the 1.0880 mark, which corresponds to 61.8% by Fibonacci, may indicate that the market is ready to sell.

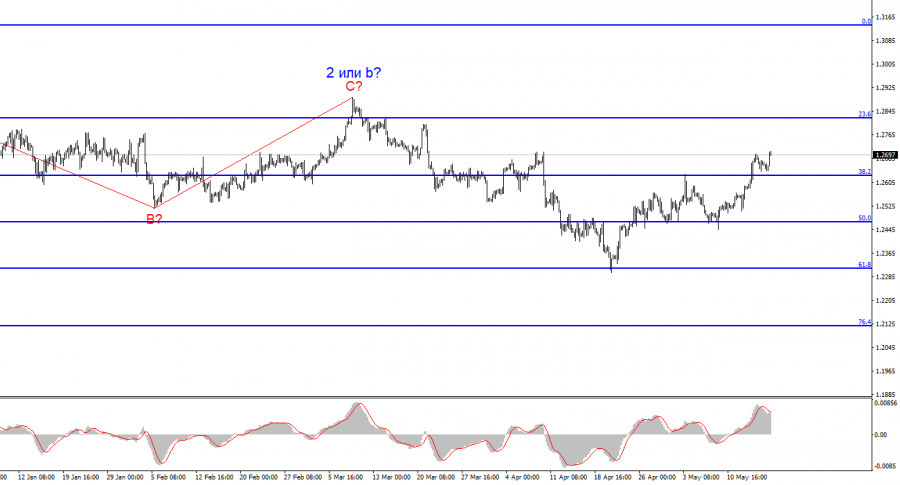

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c is being formed. A successful attempt to break 1.2625, which corresponds to 38.2% Fibonacci by Fibonacci from above, will indicate the completion of an internal, corrective wave 3 or c, which looks like a classic three-wave pattern right now.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/1GYu3CA

via IFTTT