After the party comes the hangover. The EUR/USD surged to its highest levels since the end of March, and it brings a sense of deja vu. Back then, just as now, all three major U.S. stock indexes hit new record highs. A few days later, a correction followed, triggered by rumors that the Federal Reserve would keep the federal funds rate at a peak of 5.5% longer than previously expected. Has anything changed following the April U.S. inflation report? Quite possibly not.

According to New York Fed President John Williams, there is currently no reason to adjust the Fed's current monetary policy stance. He does not expect any reasons to appear in the near future. Williams believes that inflation will slow to 2.5% by the end of 2024 and will reach the target on a sustainable basis only in 2025. His colleague from Chicago, Austan Goolsbee, is pleased with the slowing CPI but needs to see more similar reports before considering easing monetary policy.

Minneapolis Fed President Neel Kashkari believes the federal funds rate is in the right place, and the biggest question is whether it is slowing down the economy. After a series of disappointing reports, investors believe it is. However, the leading indicator from the Atlanta Fed has been fluctuating between 2.5-4.0% for a long time. What kind of GDP cooling can we be talking about?

U.S. GDP forecast dynamics

According to Nordea Markets, there is no talk of GDP slowing down. Employment growth of 150,000 and above indicates a healthy labor market. The upward revision of corporate profits points to high domestic demand, as do decent wage growth and still high household savings rates. The company changes its forecast for the start of the Fed's monetary expansion from September to December and expects EUR/USD to fall to 1.07 by mid-year, followed by a recovery to 1.1 by the end of 2025.

The reason for such a recovery is cited as the positive impact of lower U.S. rates on the global economy. As a result, pro-cyclical currencies like the euro and the pound will benefit. It seems that this is the scenario investors expect to see, but not in 2025—right now.

New records in U.S. stock indexes suggest that the markets are mistaking wishful thinking for reality. The Fed will not rush to cut rates based on a single Consumer Price Index report. The central bank needs more data, so it is quite likely that the EUR/USD rally has gone too far. The pair has established its trend, but it is on track to face challenges.

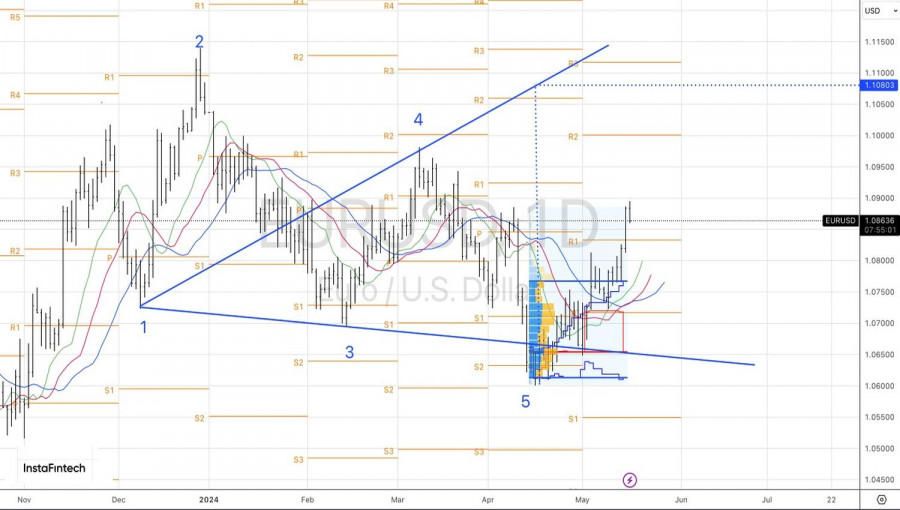

Technically, on the daily chart, EUR/USD bears are playing out the 20-80 bar. Typically, if quotes do not return to its base within two days, the initiative shifts back to the bulls. Therefore, a rebound from the resistance zone of 1.0830-1.0845 makes sense for buying the main currency pair. The target for long positions is set at 1.1080.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/dLCVuNG

via IFTTT