USD/JPY

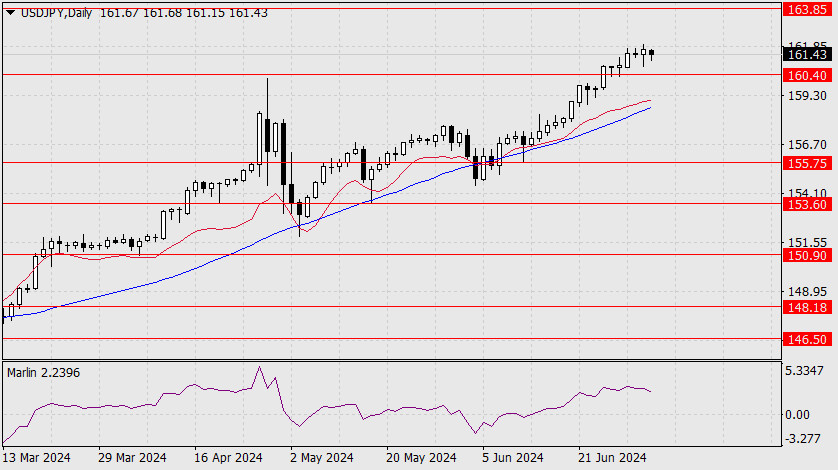

As of today, Independence Day in the US, the Bank of Japan has not conducted any intervention. This suggests, as we wrote in the review from June 2, that a currency intervention is possible on Monday, the 8th. For now, the price, after consolidating above 160.40 on June 27, continues to move sideways above this level.

The Marlin oscillator is turning downwards. We will find out next week whether this serves as a warning of an impending intervention.

On the 4-hour chart, the price and the Marlin oscillator have already formed a quadruple divergence. The Marlin oscillator continues to decline in negative territory.

The price is now supposed to return to the support at 160.40. But first, it must deal with the support of the MACD line at the 161.06 level. A break above yesterday's high will set the stage for a rise to 163.85.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/f1YhR06

via IFTTT