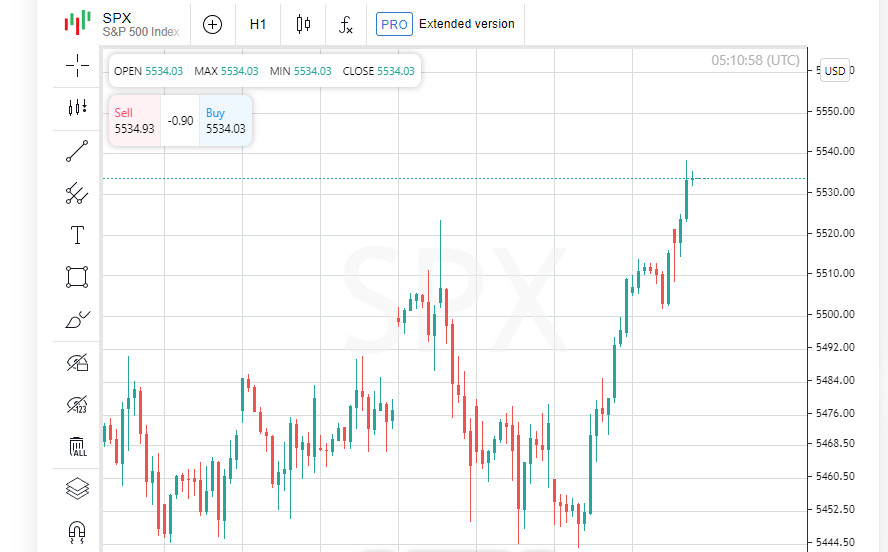

The S&P 500 and Nasdaq hit new records on Wednesday amid data signaling a slowdown in economic growth, raising speculation that the Federal Reserve could cut interest rates in September.

The Dow Jones Industrial Average ended the day marginally lower, weighed down by selling in health care and consumer staples during the shortened trading session ahead of the Fourth of July holiday. The market will be closed Thursday for Independence Day, limiting trading volume this week.

ADP employment reports and weekly jobless claims show an improving labor market ahead of Friday's nonfarm payrolls report, with markets hoping signs of weakness in the economy will prompt the Fed to cut interest rates.

Also, the Institute for Supply Management's PMI data came in below expectations, while factory orders unexpectedly fell. Investors have raised their bets on a September rate cut to more than 70%, according to LSEG's FedWatch data.

The Fed's June meeting minutes will be released after the market closes. Tesla (TSLA.O) shares rose 6.5% to a six-month high after jumping more than 10% on Tuesday on a smaller-than-expected decline in second-quarter auto deliveries.

The Philadelphia SE Semiconductor Index (.SOX) added 1.92%, led by gains in U.S.-listed Taiwan Semiconductor Manufacturing and Broadcom (AVGO.O).

Nvidia (NVDA.O) shares rose 4.6% after falling the previous day, while big names like Amazon (AMZN.O) ended the day down 1.2%.

The S&P 500 has gained more than 15% in the first half of 2024, thanks in large part to leading tech stocks. Meanwhile, the equally weighted S&P 500 (.SPXEW) has gained only 5%, with small and midcap stocks lagging significantly.

The Dow Jones Industrial Average (.DJI) lost 23.85 points, or 0.06%, to close at 39,308.00. The S&P 500 (.SPX) added 28.01 points, or 0.51%, to 5,537.02. The Nasdaq Composite (.IXIC) rose 159.54 points, or 0.88%, to 18,188.30.

Paramount Global (PARA.O) jumped nearly 7% after Shari Redstone's National Amusements tentatively agreed to sell a controlling stake in the media giant to David Ellison's Skydance Media.

First Foundation (FFWM.N) lost nearly 24% after the lender's surprise announcement that it was raising $228 million in capital for its vast portfolio of multifamily loans.

Advancing stocks outnumbered decliners 2.65 to 1 on the New York Stock Exchange, with 287 new highs and 50 new lows on the day. The S&P 500 posted 20 new 52-week highs and 4 new lows, while the Nasdaq Composite posted 51 new highs and 114 new lows.

Volume in the shortened U.S. session was 7.11 billion shares, well below the 11.64 billion shares average for the full session over the past 20 trading days.

The MSCI World Equity Index (.MIWD00000PUS) rose 0.60% to 811.63, while Europe's broader STOXX 600 (.STOXX) rose 0.81%.

The dollar index, which measures the dollar against a basket of currencies including the yen and the euro, was down 0.43% at 105.21, while the euro was up 0.5% at $1.0798.

The yield on 10-year Treasuries fell after jobless claims data and signs of weakness in the manufacturing sector. The ISM non-manufacturing index was below expectations, helping push the 10-year yield down 8.5 basis points to 4.351%.

The dollar index, which measures the dollar against a basket of currencies including the yen and the euro, was down 0.45% at 105.19, while the euro was up 0.53% at $1.0801.

The yen hit a fresh 38-year low against the US dollar and a record low against the euro ahead of the US Fourth of July holiday. The yen fell to 161.96 per dollar, its lowest since December 1986.

Oil prices stabilised after a strong rally driven by a better-than-expected draw in US crude inventories. However, economic woes in China and the eurozone limited further gains.

Brent crude futures rose 0.16% to $86.40 a barrel, while US West Texas Intermediate (WTI) futures rose 0.11% to $82.94 a barrel.

Gold prices rose more than 1% to a nearly two-week high amid a weaker US dollar. Spot gold rose 1.42% to $2,362.46 an ounce, while US gold futures rose 1.66% to $2,361.60 an ounce.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/1f0ia8N

via IFTTT