Your left hand doesn't know what your right hand is doing. Republicans have spoken openly about the dangers of a strong US dollar, which is undermining the competitiveness of American manufacturers. They are ready to pressure the Federal Reserve and intend to use currency interventions to lower the USD index. Unfortunately, the big banks don't believe them.

Deutsche Bank argued that it would be very difficult to break the upward trend of the greenback, as it would cost trillions of dollars. This is not the Japanese yen. The US dollar is a currency with global reserve status, and traders will be much more active in buying dips in the USD index compared to USD/JPY. An alternative might be policies that stimulate capital outflows from the US, but will this benefit the economy?

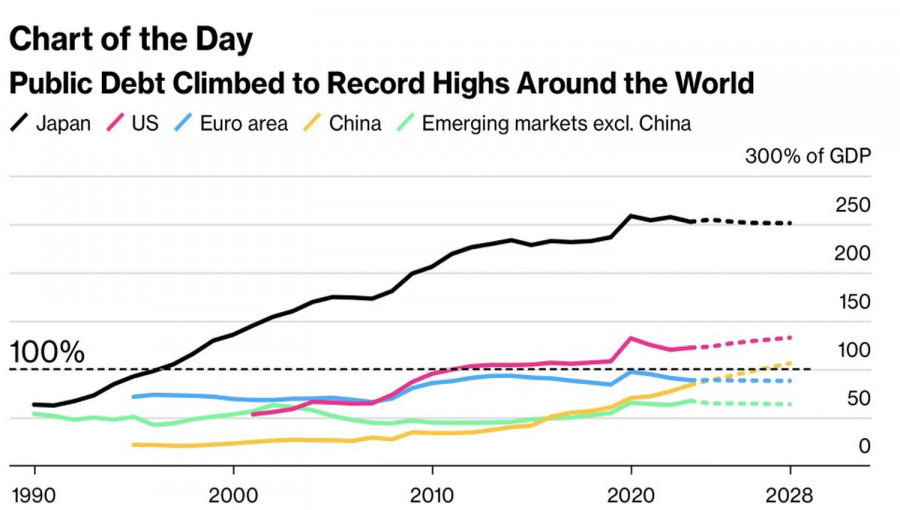

Another problem is the mountain of debt. Globally, it has risen by $2 trillion to a record $56 trillion in 2024. In such conditions, the risk of defaults increases, and investors will seek refuge in safe havens like the US dollar. The same can be said for political pressure on the Fed from the White House, strengthening demand for the USD index.

Debt Dynamics of Leading Countries

Barclays believes that implementing the tariff policy proposed by the Republicans is enough to strengthen the US dollar by at least 4% against the Chinese yuan. In this situation, the bank recommends using the recent weakness of the USD index to re-enter long trades. Morgan Stanley agrees, believing that the trade war, especially considering potential retaliation from China, poses a risk of slowing down the global economy. Pro-cyclical currencies like the euro and the pound risk being pressured. In contrast, the greenback will shine as a safe-haven asset.

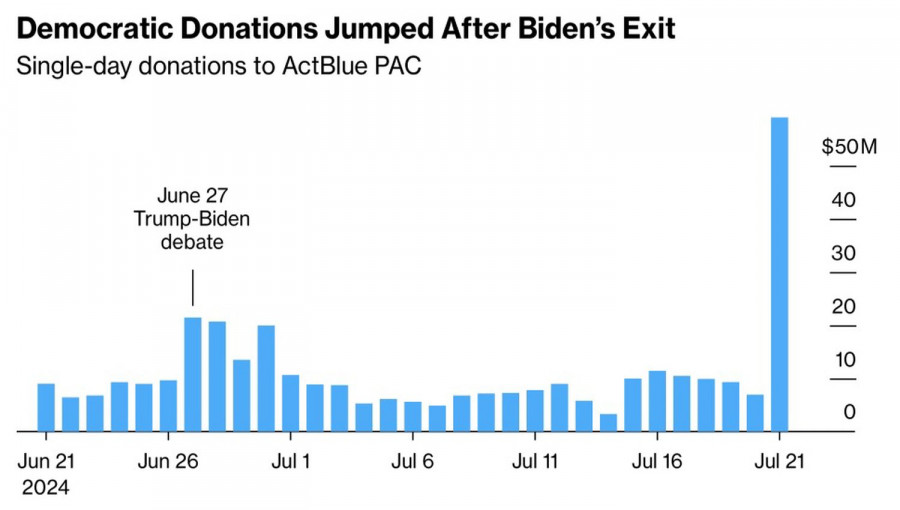

Deutsche Bank concludes that tariffs and their consequences for the dollar are significantly more likely to be the dominant market outcome than policies to pursue a weaker dollar. Republicans are prepared to drive the global economy into such a state where high-yield currencies will feel out of place. At the same time, Donald Trump's chances of winning the presidential race are significantly higher than his competitors. It is worth noting that Joe Biden's exit from the race has led to a surge in donations for the Democrats.

Donation Dynamics of the US Democratic Party

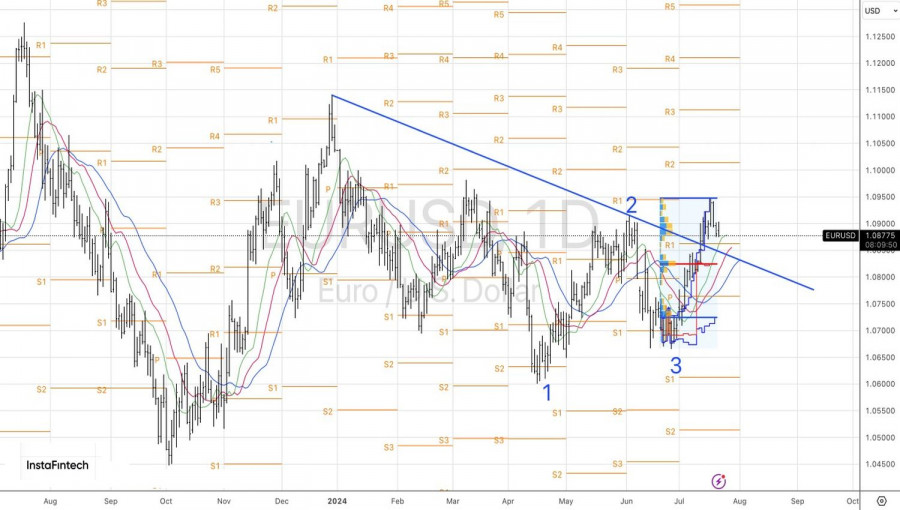

Will the perennial second Kamala Harris be able to compete with the eccentric Republican? The markets do not believe it and continue to seek a balance between Trump's trade policies and the imminent rate cuts by the Fed. This results in a pullback in EUR/USD with increasing risks of consolidation.

Technically, on the day chart, the main currency pair is going through a correction within the uptrend. However, the sentiment remains bullish as long as the quotes stay above the trendline and the convergence zone formed by pivot levels at 1.0825-1.0835. It makes sense to buy EUR/USD.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/wMVGn0S

via IFTTT