Why did the US dollar fall rapidly in August? TD Bank cites three reasons: the slowdown in the American economy, market overestimation of the scale of the Federal Reserve's monetary easing in 2024, and investors adjusting their positions. As summer draws to a close, bearish sentiment among speculators for the greenback has reached its highest levels since January. The market then expected six or seven acts of monetary easing from the Fed in the new year. It didn't wait. As a result, the EUR/USD pair declined. Does this remind you of anything?

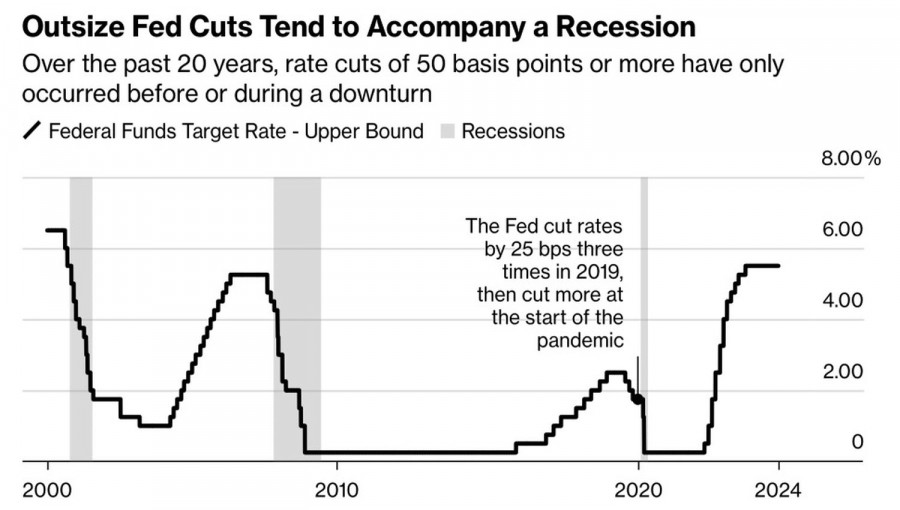

A 100 basis point cut in the federal funds rate in 2024. Can you believe it? The Fed has only aggressively eased monetary policy when a recession was underway. This was the case in 2020, when the US economy declined due to the COVID-19 pandemic. This was the case during the time of Paul Volcker. However, in most cases, the central bank took a different approach. It would lower rates by 25 bps to observe how each move would impact the economy.

Dynamics of the Federal Funds Rate and US Recession

Investors have short memories and like to use trading patterns. So it is not surprising that the Fed's dovish turn at the end of 2023 and Fed Chair Jerome Powell's statement in Jackson Hole about the imminent start of a monetary easing cycle were perceived as reasons to get rid of the US dollar. The market wanted everything to happen quickly, just like in 2020. It acts first and thinks later.

However, if you are turning the ship around and there is no storm on the ocean, it makes sense to use a different approach. One should act methodically, gradually, and carefully to avoid spoiling what has been achieved. And will the Fed rush if inflation has not yet reached the target? Why repeat the mistakes of its predecessors, who declared victory too early in the 1970s and paid for it with a double recession?

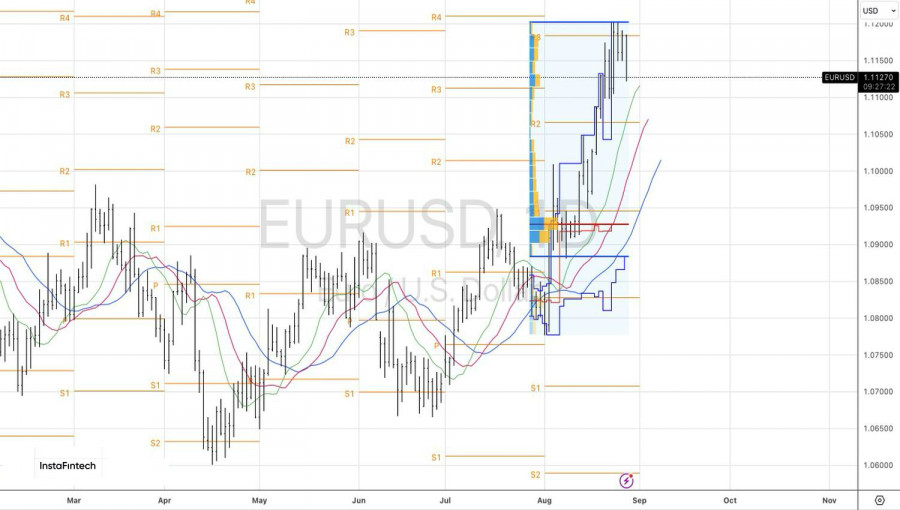

No, the Fed will not rush. Therefore, the interest rate differential with other central banks will benefit the US dollar. Danske Bank believes that the fair value of EUR/USD is around 1.10, which means that the move towards 1.12 was excessive. TD Bank warns that a slowdown in global GDP will soon manifest in response to the weakness of the US economy. This is bad news for pro-cyclical currencies like the euro and pound but good news for safe-haven assets, particularly the US dollar.

But the US presidential elections will probably start to favor the EUR/USD bears. Political uncertainty will increase financial market volatility and drive investors to seek safe havens regardless of who wins. Isn't that a good reason to sell the major currency pair?

Technically, on the daily chart, EUR/USD is experiencing a pullback from the uptrend. If the pivot level at 1.1110 does not stop the bears, the pair risks sliding to 1.1065. Short positions from 1.118 and built up from 1.115 should be maintained.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/hy7KN3D

via IFTTT