Markets are trading in narrow ranges awaiting decisions from the Federal Reserve, Bank of England, and Bank of Japan. US equities were slightly higher, unlike its European counterparts, which closed in the red on Monday, with the Euro Stoxx 600 down by 1.13%. Sentiments worsened following comments from the European Central Bank that interest rates in the eurozone will remain high for a long time, and Reuters reports that the ECB plans to soon start discussing how to tackle the excess liquidity in banks

Pressure on the euro could intensify as the market sees the deposit rate peak at around 4%, suggesting that the ECB has probably reached the top in the current tightening cycle. ECB comments also appear dovish, with Vice President Luis de Guindos stating that underlying inflation should continue to moderate, while Governing Council member Kazimir hinted that the September rate hike may be the final one of the cycle. Also speaking, Villeroy said that the ECB would keep interest rates at 4% for as long as necessary to tame inflation, indicating that he does not favor future increases at this stage.

Regarding the outcome of the FOMC meeting on Wednesday, forecasts have not changed - markets believe in another pause. The intrigue lies in whether the committee will hint at the possibility of further policy tightening, especially after Fed Chairman Jerome Powell said three weeks ago in Jackson Hole that "we are attentive to signs that the economy may not be cooling as expected,".

NZD/USD

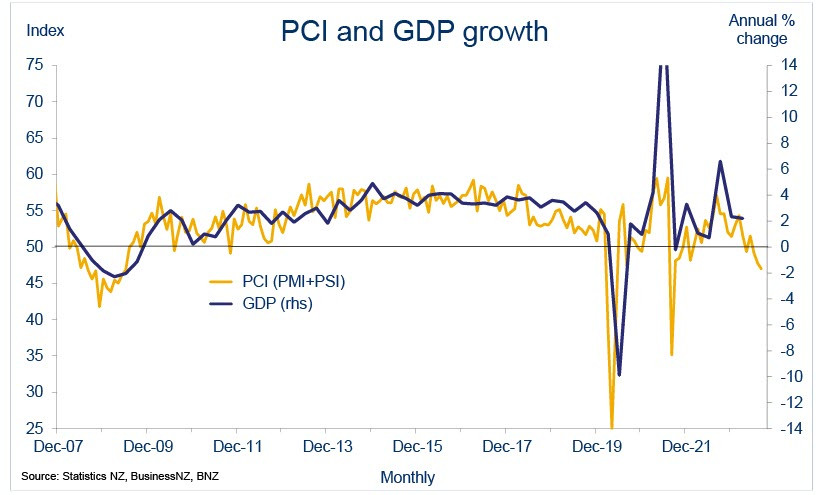

On Wednesday, New Zealand's GDP data for the second quarter will be published. A growth of +0.6% is expected, which would signify an exit from the technical recession (+0.7% in Q4 and -0.1% in Q1). However, economic activity remains subdued, with the Manufacturing PMI at 46.1 in August and 47.1 for the Services PMI, both worse than in July.

The expected GDP is attributed to a strong increase in exports in the second quarter and a slowing decline in private consumption. Both indicators are unstable and do not provide grounds for believing that the threat of a recession is in the past. BNZ bank sees annual growth hovering to about zero in the coming quarters before significant expansion resumes on an annual basis. On a per capita basis, the outlook is even worse.

On Wednesday, ahead of the GDP data, the balance of payments data for the second quarter will be published. In the 2022 calendar year, the current account deficit amounted to 9.0% of GDP, which is quite high, and some positive dynamics are needed to support the kiwi's exchange rate.

The Reserve Bank of New Zealand interest rate forecast remains unchanged, with no expected rate hikes at the next meeting. Perhaps, rising oil prices may lead to a change in the rate forecast, but this is unlikely to happen in the short term.

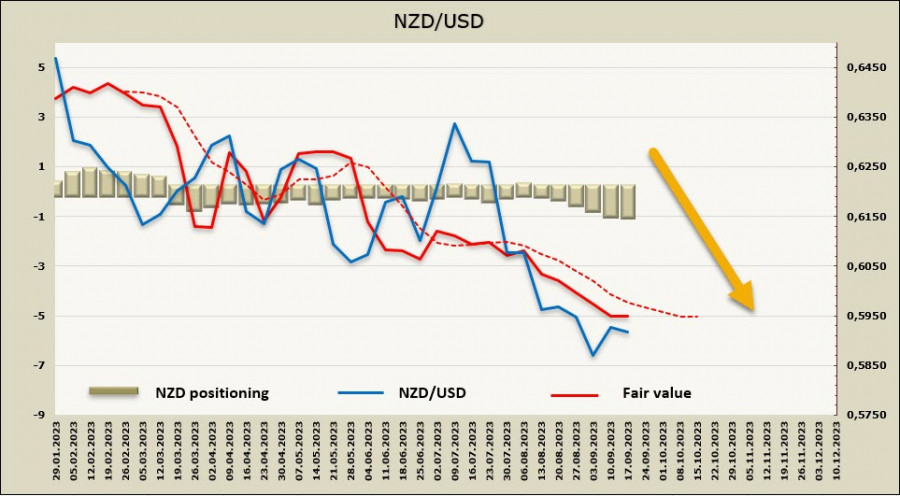

The net short NZD position increased by 39 million to -863 million during the reporting week, indicating a growing bearish bias. At the same time, the implied volatility, while remaining below the long-term average, has lost momentum, increasing the likelihood of a bullish correction within the bearish trend.

The kiwi continues to trade near the lower band of the bearish channel, but there have been no attempts of a breakthrough yet. There are several reasons for this: improvements in the economy, which has not fallen into recession; reduced concerns about a slowdown in China; and rising commodity prices. However, there are no signs of a trend reversal, so the correction will likely be shallow and limited to the zone near the middle of the channel at 0.6030/50. A more likely scenario is a resumption of the decline, with the nearest target at 0.5852, followed by the channel's lower band at 0.5810/20. A strong downtrend is unlikely.

AUD/USD

The AUD is trading in a narrow range. The minutes of the Reserve Bank of Australia meeting was released on Tuesday morning, but there was nothing surprising about it. Committee members noted that inflation continues to decline, albeit at a slow pace, and even a sharp rise in oil prices will not change the trend. Wage growth is stable, and it is expected to remain at 4% this year, which is in line with the overall strategy to combat inflation and does not raise concerns.

Since the minutes indicate that a 0.25% rate hike was considered at the meeting, markets will interpret this signal as hawkish, as it maintains the possibility of another rate hike and provides some support for the aussie. However, market rate expectations remain unchanged, and the peak is seen near current levels, which are lower than in most countries, so long-term bearish pressure on the AUD remains.

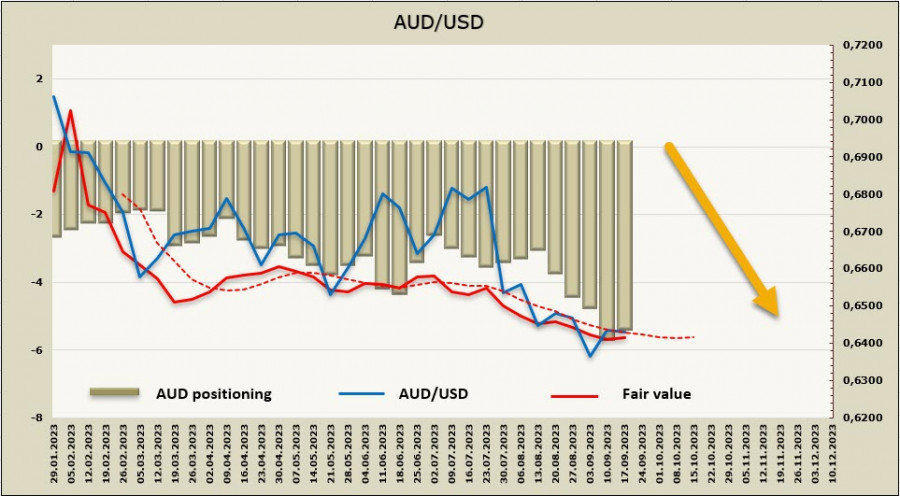

The net short AUD position fell by 218 million to -5.111 billion during the reporting week. The positioning is still bearish, and the implied volatility remains below the long-term average, but it has lost momentum, increasing the chances of a correction.

In case the aussie corrects higher, the nearest resistance is at 0.6525, followed by the middle of the channel at 0.6550/70. The Australian currency does not have a strong reason to rally, let alone a firm uptrend. It is more likely to fall, with the nearest support at 0.6358, followed by the channel's lower band at 0.6280/6300. A strong decline is unlikely, as macroeconomic indicators do not suggest increased risks for the AUD. Instead, it will likely trade in a sideways range while awaiting new data.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/1uoeq2P

via IFTTT