The EUR/USD pair concluded the trading week at 1.0658. For the first time since May, the exchange rate settled within the 1.06 range, confirming the strength of the downward movement. Take a look at the weekly EUR/USD chart: the pair has been in a downtrend for the ninth consecutive week. Since mid-July, there hasn't been a single bullish candle on the weekly chart. The main driving force behind the decline is the greenback, which is gaining more strength due to the favorable fundamental backdrop.

The news flow is volatile, but dollar bulls manage to take advantage of any circumstances. In the middle of the summer, the dollar received support from the Federal Reserve, which unexpectedly raised the interest rate contrary to the forecasts of most experts who expected it to remain unchanged. Back then, July data on US inflation growth were published, which also surprised traders with their "green" hue. Fed Chairman Jerome Powell, at the Jackson Hole Symposium, only reinforced the market's hawkish expectations by suggesting another rate hike within this year. After that, the focus turned to China, which alarmed the markets with a slowdown in its economy. On the back of risk-averse sentiments, the dollar once again began to enjoy increased demand. As soon as China "recovered" (a block of economic reports for August came out in the green zone, and the PBOC made a series of stimulative decisions), the oil market immediately followed, "pleasing" dollar bulls with its increase.

So, step by step, the greenback has been climbing higher for many weeks (the US Dollar Index approached the 1.05 figure), while sellers have been stepping down briskly in response.

The past week proved to be significant for traders in many ways.

The European Central Bank, with its hawkish decision, has raised doubts about its future course of actions, if not putting a complete "question mark" on them. The prospects of further tightening of the monetary policy are now in question, as the central bank increased interest rates amid slowing key macroeconomic indicators. This is a bold decision, so to speak, "against the tide." This is why the euro reacted to the central bank's actions with a widespread decline - traders doubt that the ECB will tighten its policy again in the foreseeable future (at least within this year).

Some formulations in the accompanying statement also suggest that the central bank is ready to hit the pause button. In particular, the document states that the key interest rates "have already reached a level that will make a significant contribution to the timely return of inflation to the target value - if this level is maintained for a sufficiently long period." In plain language, this means that the ECB is ready to defend this position for many months, while keeping interest rates at the current level.

By the way, after the meeting, ECB representative Madis Muller stated that "rate hikes are not expected in the coming months." He also hinted that the regulator would return to monetary tightening only if inflation indicators start to "actively accelerate." A similar position was voiced by ECB Vice President Luis de Guindos, as well as the head of the National Bank of Slovakia, Bostjan Vasle. Therefore, despite the central bank's thesis that interest rates have not reached their peak level, the market has come to the opposite conclusion. In particular, according to SocGen analysts, this year the ECB will maintain a wait-and-see stance. At the same time, currency strategists do not rule out another rate hike in the first half of next year, as high labor costs may lead to sustainably high core inflation.

However, hawkish prospects for 2024 do not inspire confidence in the bulls: the ECB did not become a euro ally, despite the unexpected interest rate hike.

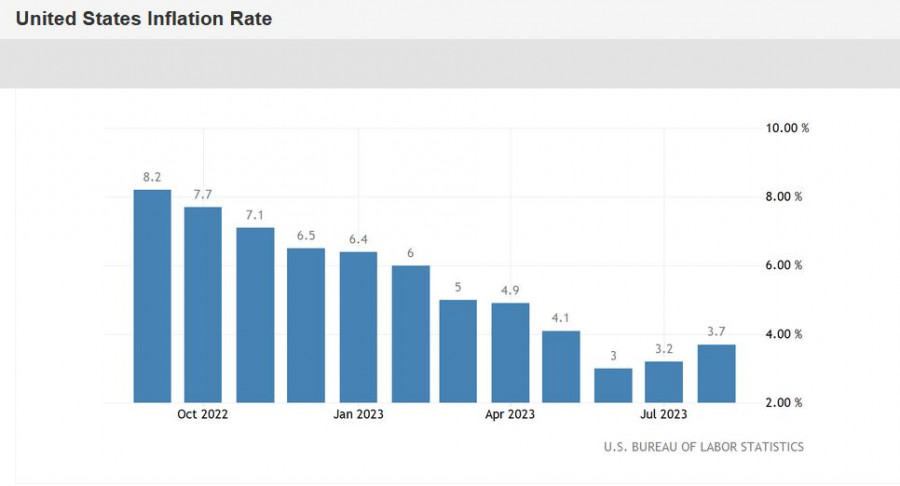

But whether the Fed will become an ally of the dollar is an open question. Recent reports on inflation growth in the US amid rising oil prices suggest that the Fed may tighten its rhetoric at the September meeting and possibly announce a rate hike at the next meeting in November. For instance, the Consumer Price Index on an annual basis accelerated to 3.7%, beating the forecast of 3.6%. This indicator has been on the rise for the second consecutive month after a 12-month decline. In monthly terms, the CPI rose to 0.6%, the highest growth rate since June 2022. The core CPI continues to steadily decline, reaching 4.3% on an annual basis (matching the forecast), the weakest growth rate since October 2021.

Another inflationary indicator, the Producer Price Index, also entered the green zone. It has been accelerating for the second consecutive month after nearly a year of continuous decline. The import price index also exceeded the forecast estimates in both monthly and annual terms.

Other macroeconomic indicators in the US were also in the green zone. For instance, industrial production increased by 0.4% in August, surpassing the 0.1% growth forecast. Retail sales volume grew by 0.6%, the best result since January of this year.

All of the aforementioned reports were published during the so-called "quiet period," during which Fed members are not allowed to publicly voice their positions. Therefore, we can only speculate about the possible reaction of the Fed to the inflation data. In my opinion, the central bank will be concerned about the situation, as, firstly, there is already a trend (rising CPI, PPI), and secondly, all of this is happening against the backdrop of the oil market's growth, which will ultimately drive inflation higher. Judging by the dynamics of the US dollar, many market participants have come to similar conclusions.

The corrective pullback in the EUR/USD pair observed on Friday was driven by positive news from China. For instance, retail sales in China grew by 4.6% YoY in August (compared to a growth forecast of 3.0%), and industrial production increased by 4.5% YoY (versus a growth forecast of 3.9%). Additional measures taken by China to support its national economy also contributed to a boost in risk sentiment in the markets. It was revealed that the People's Bank of China injected 591 billion yuan into the country's financial system through a medium-term lending facility and reduced the 14-day reverse repo rate.

This "Chinese ray of light" helped keep the EUR/USD pair above the 1.0650 support level (the lower Bollinger Bands line on the daily chart). It is quite likely that in the coming days, leading up to the announcement of the results of the Fed's September meeting (scheduled for September 20th), the pair will trade within the range of 1.0650 to 1.0720. The Fed, in this case, will act as a kind of arbiter, either allowing the EUR/USD bears to move towards the 1.05 figure or pushing the pair back towards the 1.08-1.09 range. In the run-up to such significant events, the pair typically goes into a drift, exhibiting sideways movement.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/5mryHfx

via IFTTT