The euro and the pound started the new week "at the bottom," but with prospects. First of all, I would like to note that both instruments are near important Fibonacci levels, unsuccessful attempts to break through which can push quotes upward, coinciding with the need to build a corrective wave 2 or b for both. Also, the market's reaction last week to the European Central Bank's interest rate hike proved significant. The market showed that it's not the rates themselves and their changes that matter, but the prospects of monetary policy. Based on this understanding, we can draw some conclusions.

The Bank of England is expected to raise the interest rate by another 25 basis points on Thursday... which could trigger a new drop in the pound. If the ECB was close to completing its tightening cycle last week (and it got even closer), then the BoE is no further from the "finish line" than the ECB. Therefore, its rate hike may also be perceived by the market as dovish. However, even in this case, I do not expect the pound to drop by another 200-300 points. At least partly because the Fed's meeting is scheduled for Wednesday, and the U.S. central bank's decision may be even more dovish. Although from another perspective, a very interesting paradox is possible.

Markets have been waiting for the Fed to announce the end of its tightening cycle for several months now and still haven't received it. In September, the Fed should not raise interest rates, but there has been no announcement of the end of the tightening process, and inflation increased in July and August. Therefore, by the end of the year, the rate should increase at least one more time. It turns out that the BoE's rate hike may be perceived as a dovish decision, while the Fed's rate hike as a hawkish decision. Predicting how the instrument will move in this context is quite challenging. One should simply rely on the wave pattern.

And also this week, the Consumer Price Index will be released in the UK. In August, it may accelerate once again. And then it may accelerate in September because BoE Governor Andrew Bailey himself mentioned this a few weeks ago. It's interesting, does the BoE really expect 5% by the end of the year? Is the BoE aware that there are only three and a half months left until the end of the year, and inflation is moving up again, and not easing? The acceleration of inflation practically guarantees a rate hike the next day, which does not at all guarantee an increase in the pound.

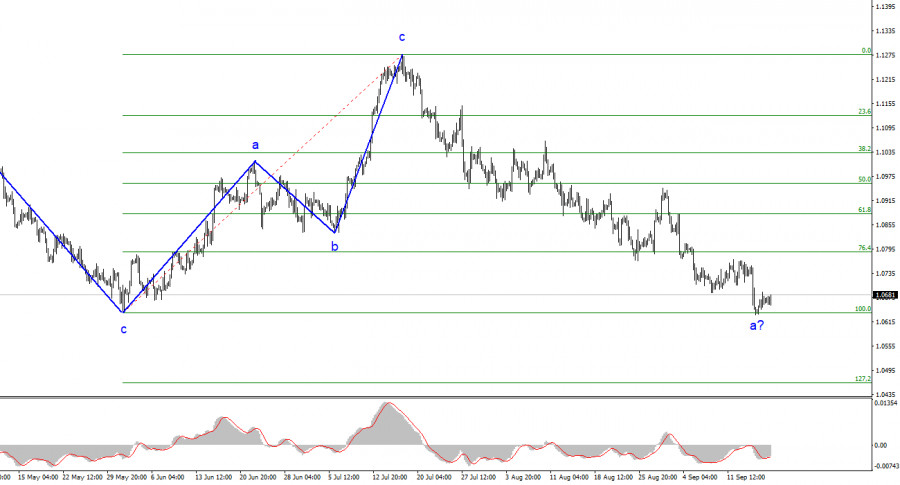

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still believe that targets in the 1.0500-1.0600 range are quite feasible. Therefore, I will continue to sell the instrument with targets located near the levels of 1.0636 and 1.0483. Failing to break through the 1.0636 level suggests a possible end of the construction of the first wave, which has taken on an extended form.

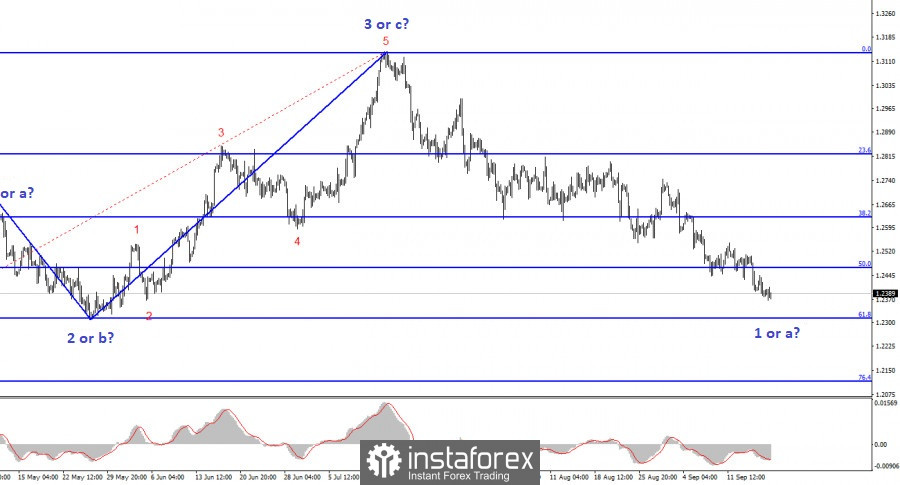

The wave pattern of the GBP/USD pair suggests a decline within the downtrend. There is a risk of completing the current downward wave if it is d, and not wave 1, but in my opinion, we are currently witnessing the construction of the first wave of a new descending segment. Therefore, the most that we can expect in the near future is the construction of wave "2" or "b". A successful attempt to break the 1.2444 level, corresponding to 100.0% on the Fibonacci scale, may indicate the market's readiness to extend the decline, so I still recommend staying in short positions with targets around 1.2311, which is equivalent to 61.8% according to Fibonacci.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/MdZbajU

via IFTTT