Most of the questions now are directed towards the Federal Reserve. The rhetoric of FOMC members has been changing too frequently lately. No, officials of the U.S. central bank do not change their views every month, but the tone of their statements constantly changes, and their position isn't as firm as it used to be. If you try to characterize the mood of most FOMC members with one phrase, it would be: "The rate change depends on incoming data." This is what President of the Federal Reserve Bank of Philadelphia Patrick Harker told us on Friday.

He believes that now is the time to carefully analyze the results of previous rate hikes, and decisions should be based on incoming data. Harker did not specify what these data should be for the rate to change (in our case, to increase). I can certainly assume that inflation should be rising, the labor market should be growing, the economy should be growing, and unemployment should be decreasing, but several of these conditions are already met. It is important to remember that the main indicator is inflation. Inflation has been rising for three months, but the Fed does not consider it enough to consider new tightening.

Harker also mentioned that the labor market is becoming more balanced, and the unemployment rate will rise to 4.5% next year. He expects economic growth rates to decline, and inflation to reach 3% next year. The last sentence, from my point of view, is very important. If the Fed includes 3% in the forecast for next year, it means that it is not in a hurry to achieve the target, contrary to the common belief that emerged from the statements of FOMC members. The Fed raised rates sharply and quickly, and it seemed that the U.S. central bank would not calm down until the target was reached. However, in the second half of this year, it has calmed down.

Now the probability of a new rate hike doesn't even reach 20%, and it doesn't matter which specific meeting is being discussed. It can be said that all three central banks are currently in a wait-and-see position, not willing to take risks. However, the Fed still has slightly more opportunities and grounds for a rate hike.

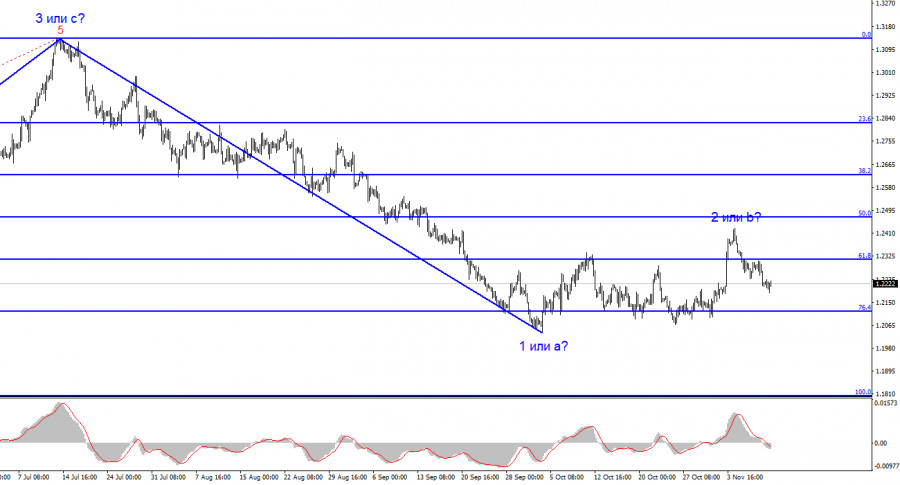

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 level, and the fact that the pair has yet to breach this level indicated that the market is ready to build a corrective wave. It seems that the market has completed the formation of wave 2 or b, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. But be cautious, as wave 2 or b theoretically may take an even more protracted form.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend segment. The most that we can count on is a correction. At this time, I can already recommend selling the instrument with targets below the 1.2068 level because wave 2 or b has ultimately taken on a convincing form and it seems complete. Initially, just a good amount of short positions should be enough because there is always a risk of complicating the existing wave.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/ib98ZU0

via IFTTT