The market is ruled by big money. However, asset managers are not always right. They have been selling the euro against major world currencies for five consecutive weeks, excluding the Swiss franc and the Japanese yen. This suggests that the euro is being used as a funding currency in carry trade operations. These are particularly popular in periods of low volatility in the Forex market. So, is the current state of the international currency market, characterized by low volatility, the reason for the decline in EUR/USD?

Dynamics of asset managers' positions on the euro

Last spring, speculative long positions on the regional currency reached a record high. At that time, asset managers expected the Fed to make a dovish pivot soon, and the U.S. economy to fall into a recession. Unfortunately, a clear message from Fed Chair Jerome Powell and his colleagues about a cut in the federal funds rate had to wait until December. At the same time, strong U.S. macro statistics indicate there is no talk of any downturn.

Thus, large players, or as they are sometimes called, "big money," occasionally make mistakes. Especially when they try to go against central banks. Currently, investors expect the ECB to cut the deposit rate by almost 100 bps starting from June. The scale of the Fed's monetary expansion is estimated at 82 bps. The start is planned for June or July. Aligning market estimates with FOMC forecasts, on the one hand, stabilized the U.S. dollar. On the other hand, it deprived the dollar of an important trump card.

Dynamics of market expectations and Fed forecasts

As for the European Central Bank, it is still unclear exactly when it will take the first step. The "doves" of the Governing Council claim that discussions on this issue could begin as early as March, possibly starting monetary expansion in April. On the contrary, the "hawks" are confident that the ECB must let the Fed go first. This is how it historically happened. Why not follow tradition?

ECB President Christine Lagarde seems to be taking a neutral position. According to the head of the regulator, data on wage dynamics in the eurozone are encouraging, but not enough to declare victory over inflation and start lowering rates. The Frenchwoman is kind of throwing a bone to the "doves," giving them the opportunity to wait for new wage data in March. At the same time, her rhetoric sets the "hawks" in a militant mood. If it is too early to loosen monetary policy, why not wait until June?

Hints of when the world's leading central banks will start can be provided by data on the U.S. Personal Consumption Expenditure Index and European inflation. They are sure to shake the main currency pair.

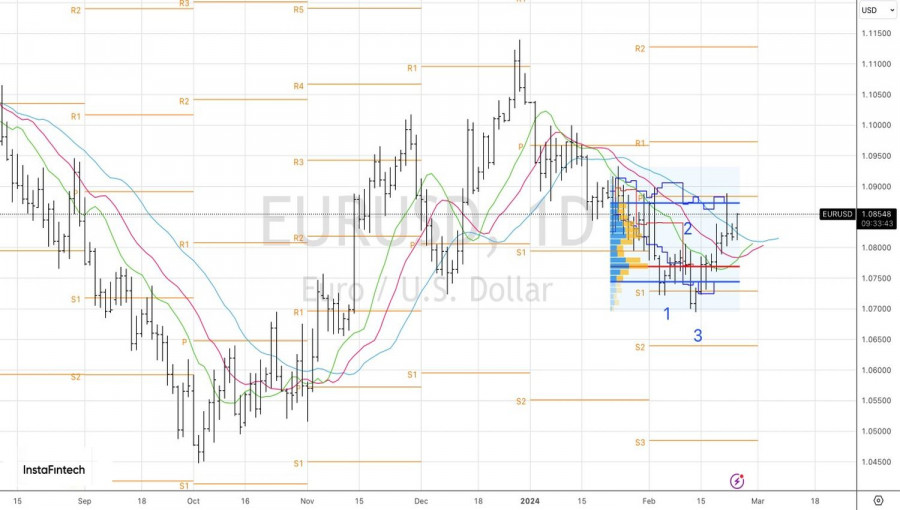

Technically, on the daily chart, EUR/USD played out an inside bar, allowing for the accumulation of previously formed long positions on the euro against the U.S. dollar from the level of 1.084. The further fate of the pair will depend on tests of the upper boundary of the fair value at 1.0775 and the pivot level at 1.0785.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/TuBUhxn

via IFTTT