The pound took a very important step. I am omitting the unreasonable basis behind the pound's growth, but the updated wave layout suggests that the pound may start a new round of upward movement. I mentioned earlier that any wave formation can take a complex structure regardless of the circumstances. Usually, the news background helps us understand what to expect from the instrument according to the wave pattern. But we're dealing with somewhat different times here. I believe that over the past few weeks, demand for the pound has grown completely out of line with the news background. Now I expect the construction of wave C in 2 or b. Based on this, the news background is not an important factor for market participants right now. Nevertheless, let's look at the events calendar for next week.

A lot of important economic reports are scheduled for release in the UK. Unemployment rate, wages, unemployment benefit claims, GDP for January, industrial production. Among these reports, it is difficult to highlight one or two that could negatively impact market sentiment. We already know and understand that even a recession in the British economy does not exert pressure on the pound. Therefore, GDP and industrial production reports will not have a strong negative impact on the pound, even if their values are weaker than market expectations.

The unemployment rate in the UK is stable, and we don't expect it to show a sharp rise. The same applies to unemployment benefit claims. In my opinion, the most important report will be on wages. If the growth rates remain unchanged in January (5.7-5.8% YoY), the market may perceive this as a signal to raise the demand for the pound. Why? The stronger the wage growth, the more difficult it is for inflation to decrease. And UK inflation is still quite far from the 2% target. A growth of 5.7-5.8% in wages is significant. British consumers have more money at their disposal, forcing producers to raise prices as demand remains high.

There are certainly more US reports next week, particularly on inflation. So let's not bury the dollar in advance, but it doesn't have a good chance of rising.

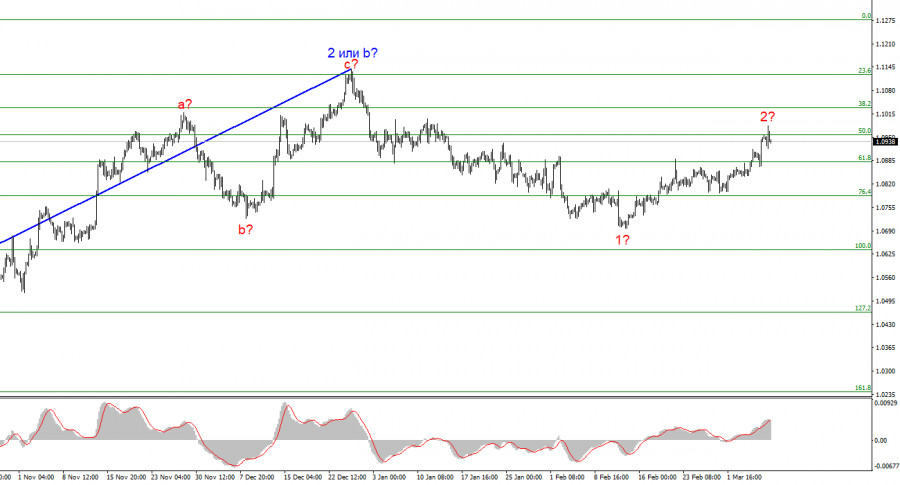

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could have already ended. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci, and I am waiting for the end of the corrective wave.

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% according to Fibonacci. A successful attempt to break through the level of 1.2877, which is equivalent to 76.4% according to Fibonacci, will indicate that the market is ready to increase the demand for the instrument. In this case, you may consider long positions.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/ymKCVRF

via IFTTT